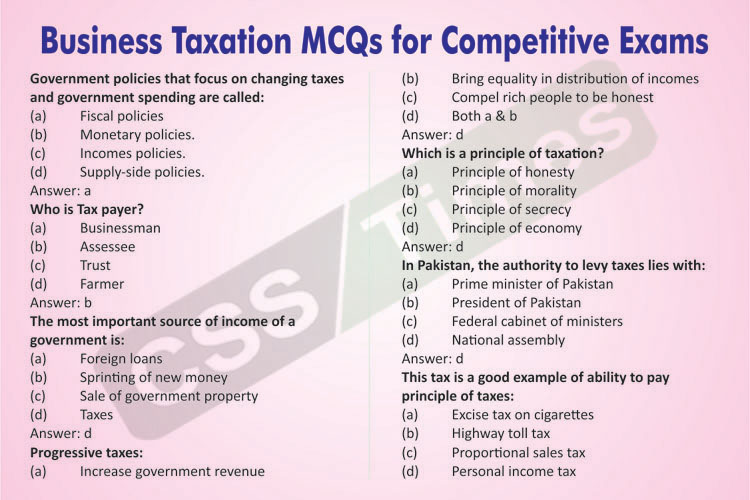

Government policies that focus on changing taxes and government spending are called:

(a) Fiscal policies

(b) Monetary policies.

(c) Incomes policies.

(d) Supply-side policies.

Answer: a

Who is Tax payer?

(a) Businessman

(b) Assessee

(c) Trust

(d) Farmer

Answer: b

The most important source of income of a government is:

(a) Foreign loans

(b) Sprinting of new money

(c) Sale of government property

(d) Taxes

Answer: d