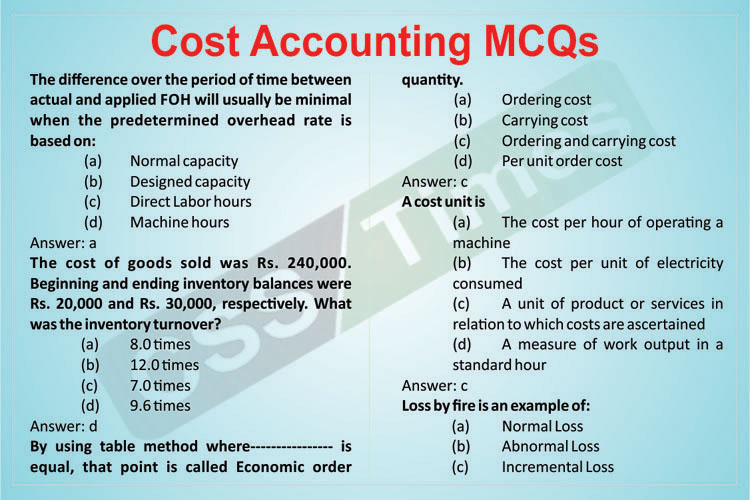

The difference over the period of time between actual and applied FOH will usually be minimal when the predetermined overhead rate is based on:

(a) Normal capacity

(b) Designed capacity

(c) Direct Labor hours

(d) Machine hours

Answer: a

The cost of goods sold was Rs. 240,000. Beginning and ending inventory balances were Rs. 20,000 and Rs. 30,000, respectively. What was the inventory turnover?

(a) 8.0 times

(b) 12.0 times

(c) 7.0 times

(d) 9.6 times

Answer: d

By using table method where—————- is equal, that point is called Economic order quantity.

(a) Ordering cost

(b) Carrying cost

(c) Ordering and carrying cost

(d) Per unit order cost

Answer: c

A cost unit is

(a) The cost per hour of operating a machine

(b) The cost per unit of electricity consumed

(c) A unit of product or services in relation to which costs are ascertained

(d) A measure of work output in a standard hour

Answer: c

Loss by fire is an example of:

(a) Normal Loss

(b) Abnormal Loss

(c) Incremental Loss

(d) Cannot be determined

Answer: a