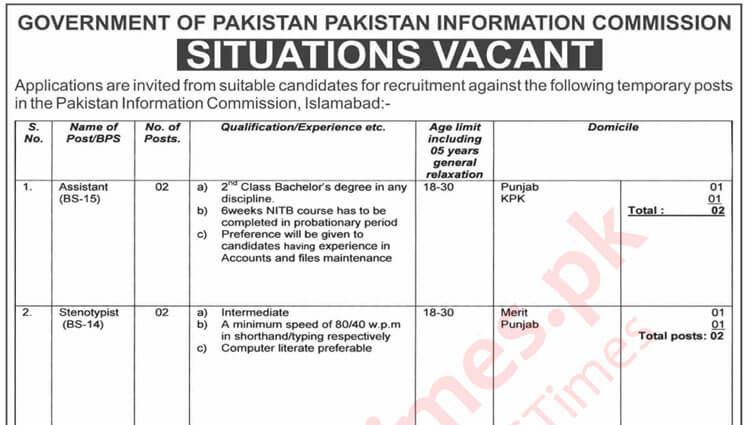

Situations Vacant in Pakistan Information Commission, Government of Pakistan

Applications are invited from suitable candidates for recruitment against the following temporary posts in the Pakistan Information Commission, Islamabad.

Applications are invited from suitable candidates for recruitment against the following temporary posts in the Pakistan Information Commission, Islamabad.

Tax amnesty scheme is a limited-time opportunity for a specified group of taxpayers to pay a defined amount, in exchange for forgiveness of a tax liability (including interest and penalties) relating to a previous tax period or periods and without fear of criminal prosecution.

It typically expires when some authority begins a tax investigation of the past-due tax. In some cases, legislation extending amnesty also imposes harsher penalties on those who are eligible for amnesty but do not take it. Tax amnesty is one of voluntary compliance strategies to increase tax base and tax revenue. Tax amnesty is different from other voluntary compliance strategies in part where tax amnesty usually waives the taxpayers tax liability.

Amnesty scheme in any fiscal year is to help State treasury raising tax revenues, adding beneficiaries in tax base who have not declared their assets previously. The main purpose of inception of this scheme is to replicate the economy and encouraging individuals to declare their wealth as it may arises. Under this scheme the beneficiary just has to pay some tax on the total assets which are declared in Amnesty scheme. State introduces this scheme when they believe that individuals are hiding their wealth from the tax authorities. Federal Government of Pakistan recently announced a tax reform package and amnesty which is expected to overhaul and change the entire taxation system in Pakistan.

The tax package revolves around five major points:

First is that CNIC numbers to be made NTN numbers to monitor tax compliance of all citizens.