Marketing Aptitude and Computer Knowledge MCQs (Solved)

A series of instructions that tells a computer what to do and how to do it is called a–

(a) Program

(b) Command

(c) User response

(d) Processor

(e) None of these

Answer: (a)

A series of instructions that tells a computer what to do and how to do it is called a–

(a) Program

(b) Command

(c) User response

(d) Processor

(e) None of these

Answer: (a)

A dealer allowed a discount of 25% on the marked price of Rs. 12000 on an article and incurred a loss of 10%. What discount should he allow on the marked price so that he gains Rs. 440 on the article?

(a) 11%

(b) 13%

(c) 19%

(d) 15%

(e) None of these

Answer: (b)

The distance between two points is 36 km. A boat rows in still water at 6 kmph. It takes 8 hours less to cover this distance in downstream in comparison to that in upstream. The rate of stream is–

(a) 3 kmph

(b) 2 kmph

(c) 2.5 kmph

(d) 4 kmph

(e) None of these

Answer: (a)

In how many different ways can the letters of the word ‘MIRACLE’ be arranged?

(a) 720

(b) 5040

(c) 2520

(d) 40320

(e) None of these

Answer: (b)

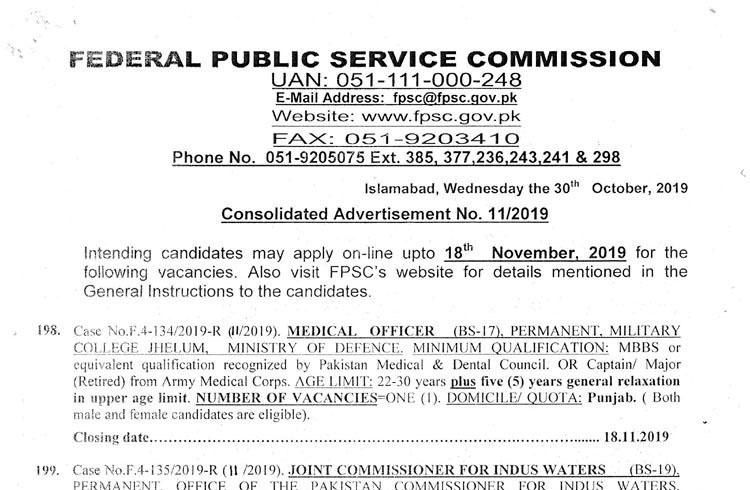

Intending candidates may apply on-line upto 18th November, 2019 for the following vacancies. Also visit FPSC’s website for details mentioned in the General Instructions to the candidates.

(05 Posts)

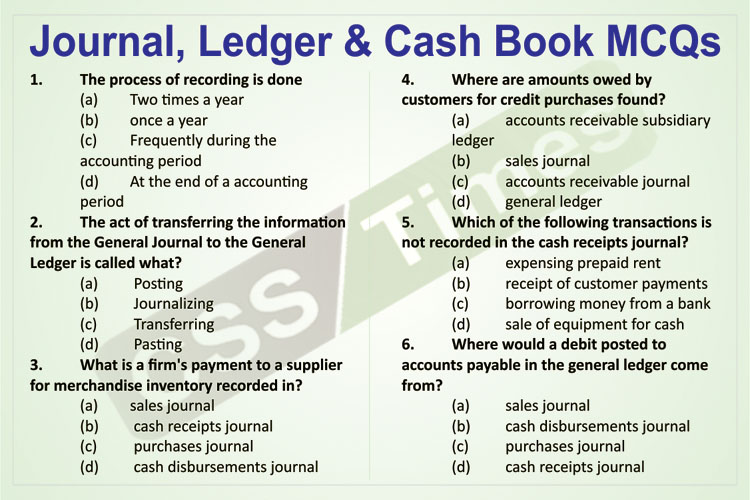

1. The process of recording is done

(a) Two times a year

(b) once a year

(c) Frequently during the accounting period

(d) At the end of a accounting period

2. The act of transferring the information from the General Journal to the General Ledger is called what?

(a) Posting

(b) Journalizing

(c) Transferring

(d) Pasting

3. What is a firm’s payment to a supplier for merchandise inventory recorded in?

(a) sales journal

(b) cash receipts journal

(c) purchases journal

(d) cash disbursements journal

4. Where are amounts owed by customers for credit purchases found?

(a) accounts receivable subsidiary ledger

(b) sales journal

(c) accounts receivable journal

(d) general ledger

5. Which of the following transactions is not recorded in the cash receipts journal?

(a) expensing prepaid rent

(b) receipt of customer payments

(c) borrowing money from a bank

(d) sale of equipment for cash